THE FOLLOWING IS CONFIDENTIAL INFORMATION THAT IS PROVIDED TO YOU FOR GENERAL INFORMATION. IT DOES NOT CONSTITUTE AN OFFER TO SELL NOR A SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES IN THE MISSION DIOCESE FUND.

BACKGROUND

The stock market turmoil in 2008 subjected Mission Dioceses to significant volatility and losses to their endowments. Based on the concern raised at the Mission Bishop Conference in the fall of 2008, Catholic Extension Society surveyed their investment needs, especially regarding long-term assets. The findings indicated that most dioceses had limited investment options and incurred high fees due to relatively low investment balances. Mission Bishops and CFOs asked Catholic Extension Society to address this situation, as management of these investments directly affected their financial viability in the long-term. As a result, Catholic Extension Society formed a pooled investment fund on behalf of the Mission Dioceses, named the Mission Diocese Fund (“Fund”), to invest long-term assets such as endowments, priest pension plans and cemetery care funds. The rationale was that access to a world-class institutional investing strategy would help build greater capacity for long-term financial stability and viability than could be achieved individually.

STRUCTURE

The Mission Diocese Fund, LLC is a limited liability company where the Mission Dioceses and associated organizations are the Members and Catholic Extension Society serves as Manager. The risk to each Member is limited to its pro rata share of ownership of the Fund. Governance is through the Chancellor and the Investment Committee of Catholic Extension Society. The offering of interests in the Fund is not subject to securities laws because of exemptions for entities such as the Fund that are organized and operated exclusively for charitable purposes. The eligible Members can only be Mission Dioceses and those organizations associated with Mission Dioceses that are exempt from federal income taxation under Section 501(c)(3) of the Internal Revenue Code. Without this structure and the securities law exemptions, it would not have been possible for Catholic Extension Society to provide this unique opportunity to Mission Dioceses.

BENEFITS

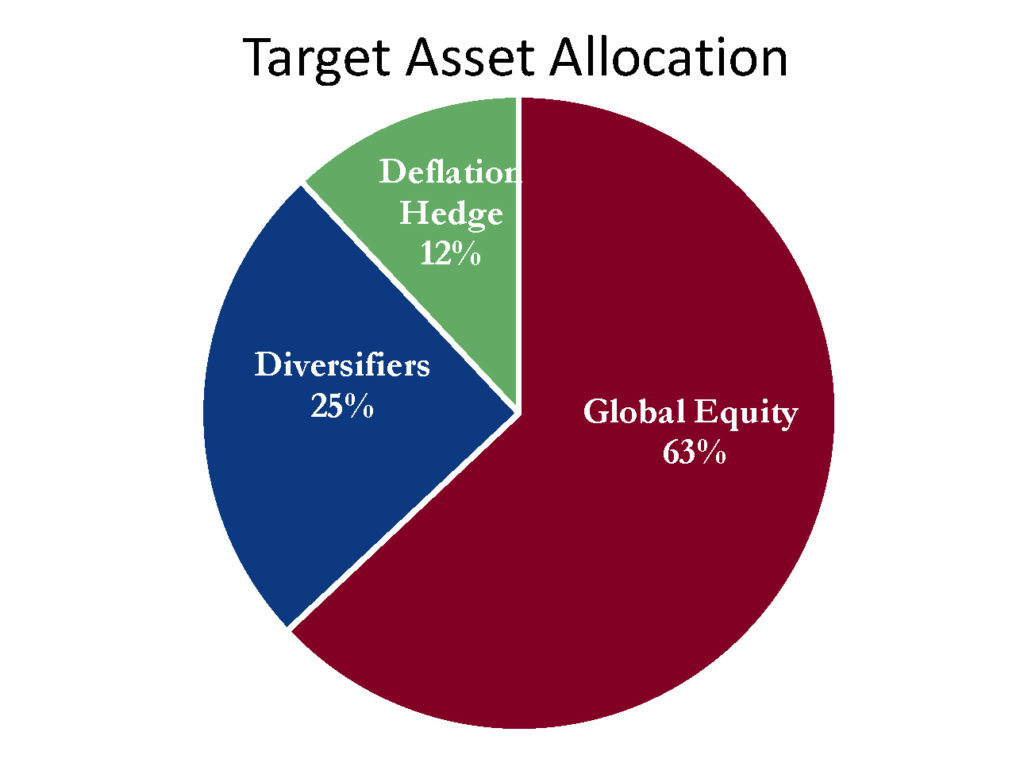

The Fund’s Operating Agreement provides various services through Catholic Extension Society, thereby subsidizing some of the costs of the Fund. The investments primarily mirror those of Catholic Extension Society’s $120 million portfolio (See Figure 1). Cambridge Associates, the investment consultant, has a long, successful track record of advising large endowments on asset allocation strategies that allow portfolios to grow over the long-term while providing income to fund mission objectives. The Fund’s current performance, (See Figure 2) has outperformed the policy benchmark in the long term.

(Figure 1)

(Figure 2)

| Performance as of September 30, 2023 | Quarter | 1 Year | 3 Year | 5 Year | Annualized Since Inception (January 1, 2012) |

| Fund, net of capped fees | (2.2)% | 15.2% | 4.9% | 4.3% | 5.8% |

| Policy Benchmark, gross return* | (2.3)% | 15.3% | 5.8% | 5.2% | 5.9% |

Past performance is no guarantee of future results.

By pooling assets, the Fund can invest in world-class fund managers that are otherwise closed to smaller portfolios, such as:

- Eagle Capital

- William Blair

- Johnston International Equity

- Kiltearn Global Equity

- Matrix

- Coatue, Ltd.

- Elliott International

- Chatham High Yield, Ltd.

The Fund applies the USCCB Socially Responsible Investing guidelines in its investment decisions.

To emphasize that this represents a service from Catholic Extension Society to the mission dioceses, the Fund’s annual “all-in” expenses are capped at 0.55% of the asset balances. Investments may be contributed at the start of each quarter, and distributions are made at the end of each quarter.

PARTNERS

- Cambridge Associates, LLC

- State Street Corporation

- Deloitte & Touche, LLP

- MSCI, ESG Research

- NRS, Trust Product Administration

Frequently Asked Questions

-

1. Why should a mission diocese consider investing in the Mission Diocese Fund?

The Mission Diocese Fund, LLC (the Fund) provides a mission diocese the opportunity to access an institutional investing strategy in compliance with the USCCB Socially Responsible Investing Guidelines to help build greater capacity for long-term financial stability and viability. The diversification of the fund’s investments are designed to provide the stability that most mission dioceses desire while producing reasonable long-term results. The Fund provides access to approximately thirty world-class investment managers that would otherwise be closed or inaccessible to smaller investors such as mission dioceses. The Fund is managed by a group of seasoned and knowledgeable professionals at Catholic Extension Society and uses Cambridge Associates as its investment consultant. All fees are capped at 55 basis points as explained in Question 8.

-

2. Who is eligible to subscribe to the Fund?

The fund is available to any diocese that is currently defined as a Mission Diocese or any charitable affiliates under the supervision of such Mission Diocese and must be exempt from Federal Income taxation under Code Section 501:

a. because it is described in Code Section 501(c)(3), and

b. described in either Code Section 509(a)(1) or Code Section 509(c)(2).

Supporting organizations that can be described under Code Section

509(a)(3) are not eligible.

-

3. How do we invest in the Fund?

Contact: Tom Riordan, 831-645-2827, triordan@catholicextension.org, or

Kevin McGowan, 312-795-5133, kmcgowan@catholicextension.org.

-

4. When are contributions accepted?

Contributions are accepted for investments at the beginning of each calendar quarter. A minimum 15 days notice is requested before the first day of each quarter. Funds are to be received at least 3 business days before the end of a quarter.

-

5. Can sub-accounts be established?

A member can have multiple sub accounts. A minimum balance of $10,000 per sub-account is requested. The manager reserves the right to assess an incremental charge for more than (10) sub-accounts.

-

6. Can regular distributions be taken?

Members may elect to have planned distributions (i.e. spend rule) taken on quarterly, semi-annual or annual basis. Since these are long term assets, we ask that regular planned distributions not exceed 5% of total investments of the account balance each year.

-

7. Can I take other withdrawals?

Unplanned withdrawals can be taken on a quarterly basis and we ask for a 75 day advance notice to the Manager. Funds are transferred within 5 business days after the end of the quarter. There are no-lock up or exit restrictions.

-

8. What expenses will the fund incur?

- The Manager, in furtherance of its charitable and religious mission, will not charge any management fee or receive any other compensation for its services.

The fund shall bear all costs and expenses incurred in its operations, including, but not limited to, expenses associated with the holding, purchase, sale or exchange of Securities, brokerage fees, legal fees, audit and accounting fees, advisory fees relating to investments or proposed investments, and fees incurred in connection with the maintenance of bank and/or custodian account. - The Manager, to emphasize that this represents a service from Catholic Extension Society to the Mission Dioceses, makes a quarterly contribution to its members to limit the “all-in” expenses of the fund to 55 basis points.

- The Manager, in furtherance of its charitable and religious mission, will not charge any management fee or receive any other compensation for its services.

-

9. How is the Mission Diocese Fund managed?

- The Manager, the Board of Governors for Catholic Extension Society has delegated the oversight of the Fund to their Investment Committee, who may consult with the Chancellor of Catholic Extension Society (the Archbishop of Chicago) from time to time.The Investment Committee sets investing policies and guidelines regarding asset classes, asset allocation ranges and prohibited investments.

- The Manager uses the services of an Investment Consultant (Cambridge Associates) to advise on the selection of portfolio managers, asset allocation and other investment research functions.

-

10. How does the Mission Diocese Fund meet the Socially Responsible Investment guidelines?

The Mission Diocese Fund diligently follows the USCCB Socially Responsible Investing guidelines using screened lists provided by MSCI.

-

11. How are the Member’s interest represented?

Catholic Extension Society and the Investment Committee encourages input from Diocesan Boards and Investment Committees because we believe good ideas and approaches can come from anywhere and can benefit all participants. Tom Riordan recently joined Catholic Extension Society to be the primary contact for the Mission Diocese Fund. He was involved in the formation and has been actively engaged since the Fund’s inception. He is available to hear any ideas and answer questions that may arise from the Member or representatives from the diocese. Tom is the primary communication link for each Member with the Investment Committee and with Cambridge Associates.

Print-ready PDF: Mission Diocese Fund Frequently Asked Questions

For More Information

Betty Assell, Senior Manager of Annuities, at 312-795-6089 or bassell@catholicextension.org

Tom Riordan, Director Mission Partnerships, at 831-320-3571 or triordan@catholicextension.org